Corporate Sustainability Reporting Directive - CSRD

- Applies to large companies in EU, companies with subsidiaries in EU, companies listed on European markets and Non-EU companies with substantial operations in the EU

- Must contain what is necessary to understand the company's impact on sustainability conditions, and information that is necessary to understand how sustainability conditions affect the company's development:

- Business model and strategies

- Goals related to sustainability

- Risks related to sustainability issues

- Indicators relevant to the above information

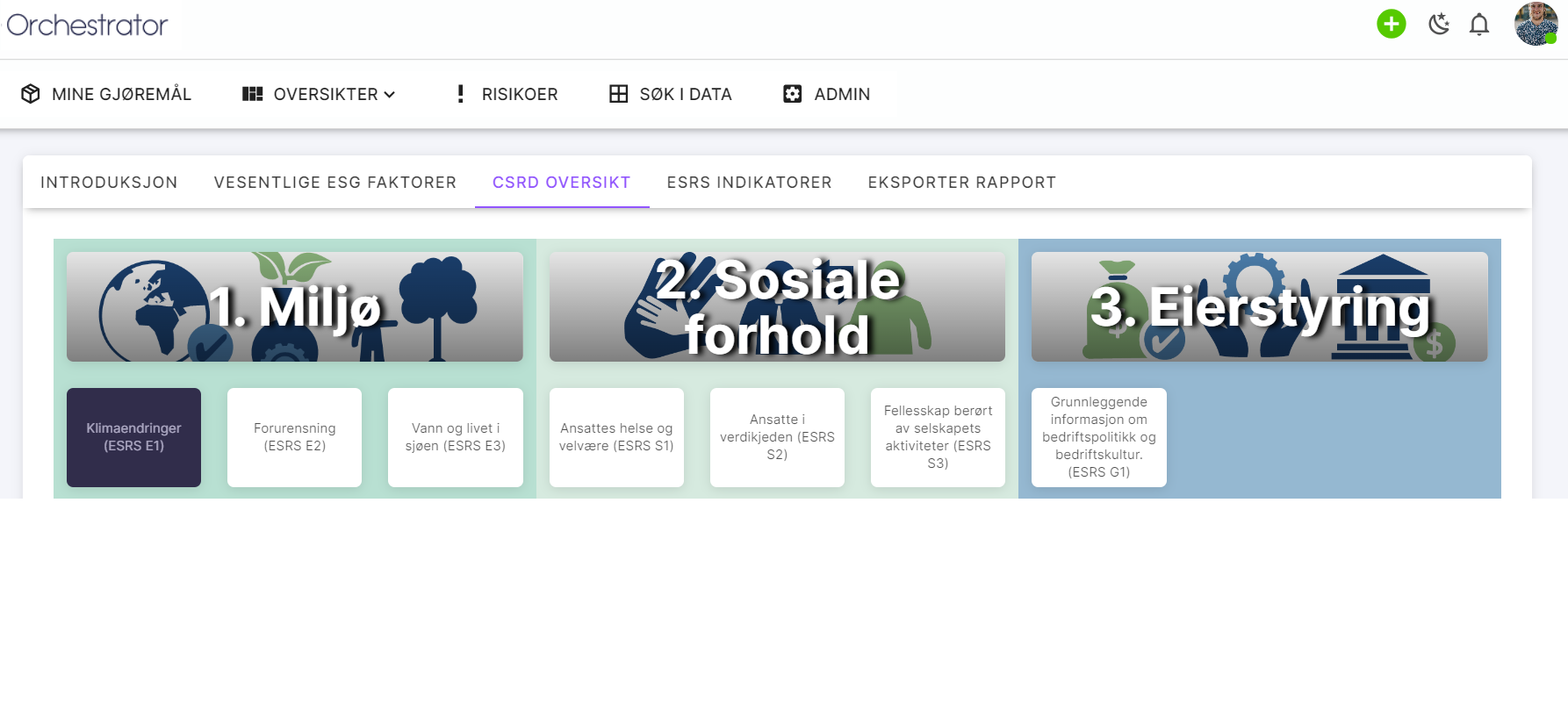

- To be reported in accordance with ESRS, European sustainability reporting standards divided into Environmental, Social and Governance (ESG) topics.

- Delivered in a European electronic reporting format (ESEF) via the European Single Access Point (ESAP)

When do you have to start reporting?

- 2024: For companies already under the NFRD.

2025: For large companies not covered by the NFRD. - 2026: For listed SMEs, small and non-complex credit institutions, and captive insurance companies.

- 2028: For non-EU companies with significant EU turnover

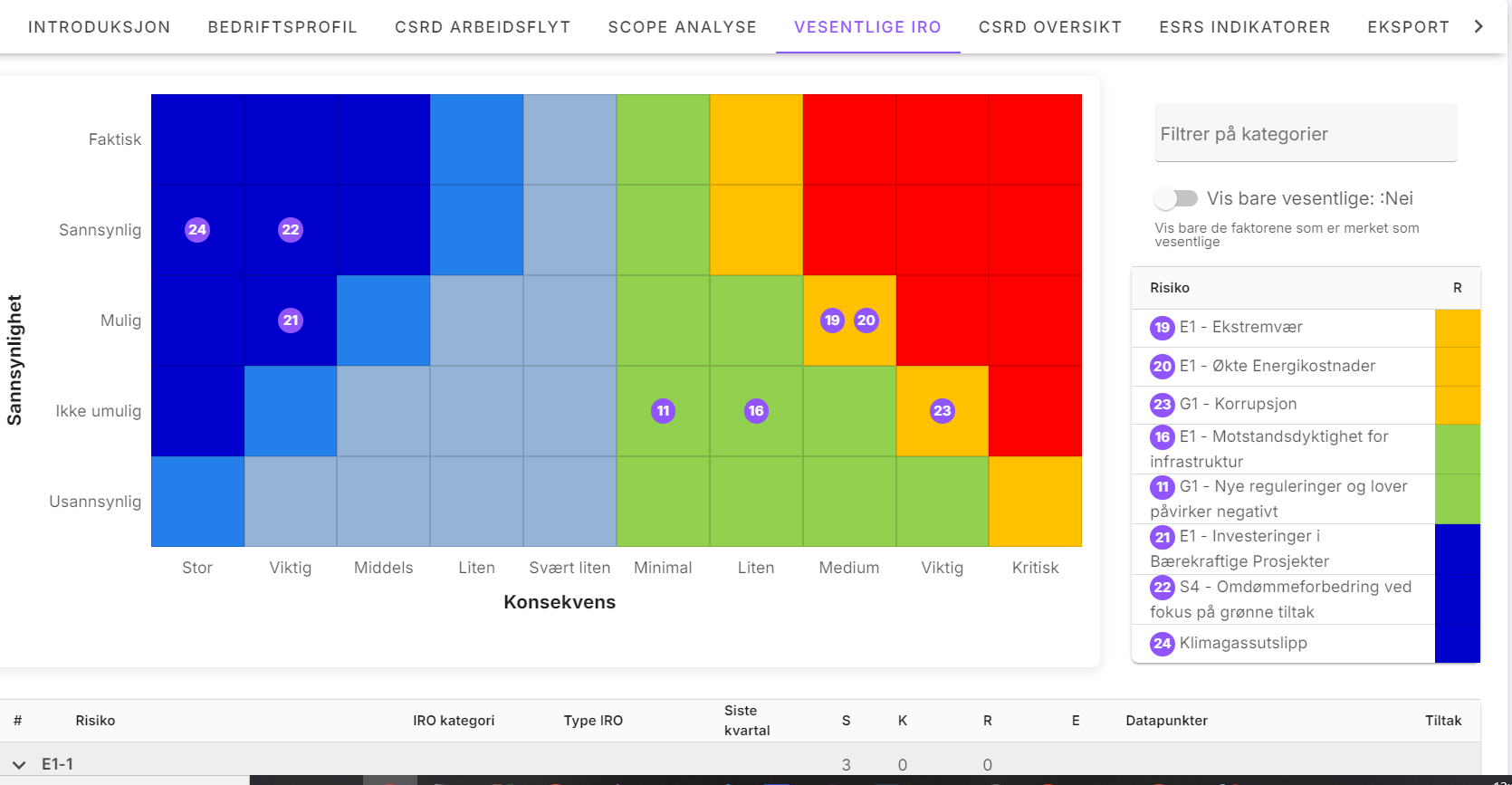

Double materiality analysis (DMA)

You should carry out a double materiality analysis well in advance of the year you are to start reporting to establish which indicators are relevant for your company.

A double materiality analysis must include impacts, opportunities and risks, for conditions that affect your company, but also how your company can affect sustainability conditions.

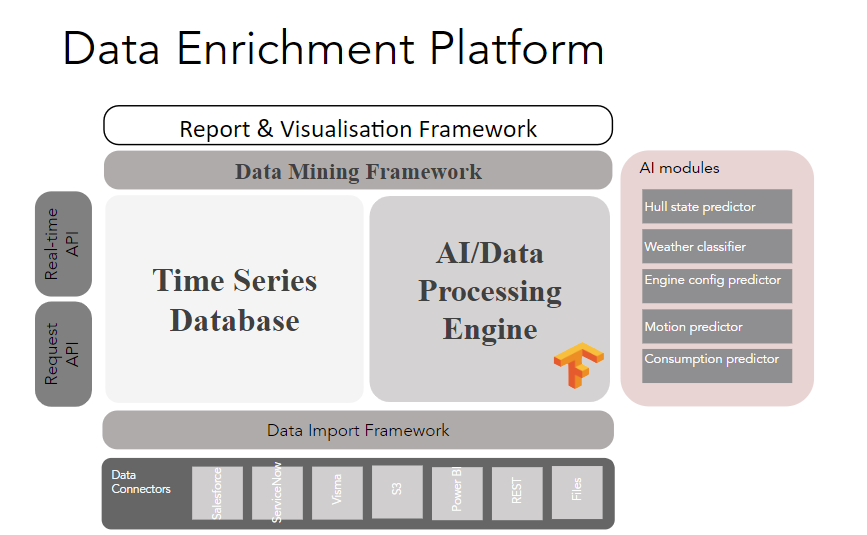

We integrate with all your company's data sources and favorite tools

Collects, monitors and analyses

Our solution gives you the ability to collect, store and analyze data relevant to ESG initiatives in one place. You can easily monitor and analyze the company's measures in various areas and report the ESG measures to stakeholders. We also ensure that the company follows international standards and best practice when it comes to ESG reporting.

Reliable and safe and supports international standards

Decision support, data and analysis and risk management

- Impact management: Identify ESG-related impacts, risks and opportunities in the business, evaluate risks over time, analyze trends, implement risk-reducing measures and document established barriers. This will be the basis for the design of a sustainable strategy to meet these challenges.

- Decision support: Integrate CSRD criteria into the decision-making process, and ensure that the company's investments and projects are in line with sustainability goals.

- Data and analysis: Collect and analyze data on CSRD-related topics. Promote sustainability and innovation by engaging employees, partners and customers in the company's sustainability strategy and help identify new sustainable business opportunities.

I find that working with CSRD reporting can be challenging, especially when it comes to understanding the requirements and collecting and analyzing relevant data from different departments and business units. It can also be difficult to get all stakeholders, both internal and external, to understand the importance of CSRD reporting and how it can affect our company's long-term success. Ensuring accuracy and reliability in reporting can also be a challenge, as it often depends on collaboration and communication across the organizational structure.

Saras problem